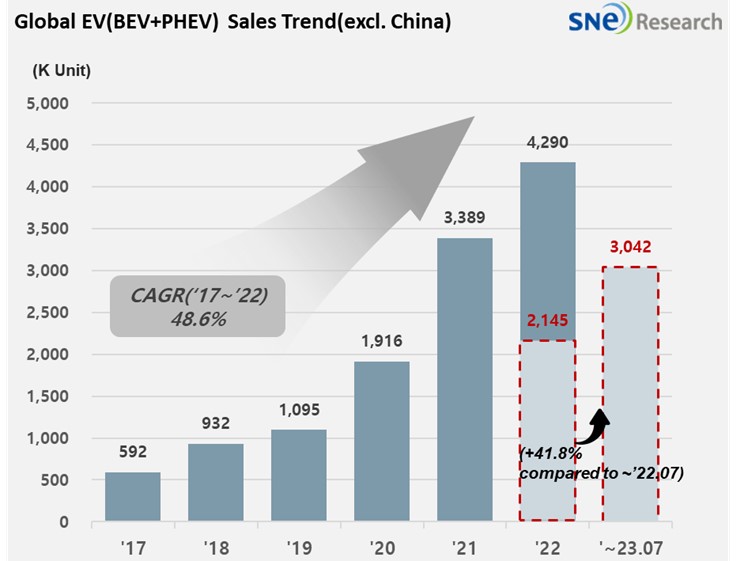

From Jan to July in 2023, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded 3.042 Mil Units, a 41.8% YoY Growth

- Tesla took top position and Hyundai-KIA ranked 4th in the non-China EV market

From

Jan to July in 2023, the total number of electric vehicles registered in

countries around the world except China was approximately 3.042 million units,

posting a 41.8% YoY growth.

(Source: Global EV & Battery Monthly Tracker – August 2023, SNE Research)

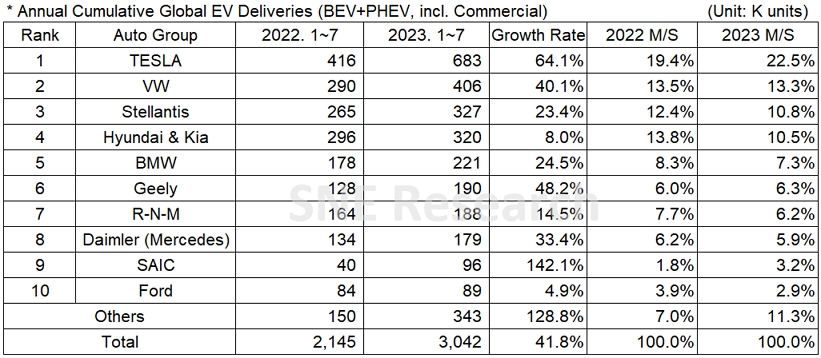

From

Jan to July 2023, if we look at the number of electric vehicles sold by OEM

groups in the non-China market, Tesla maintained the top position with a 64.1%

YoY growth. The growth of Tesla was led by the price-reduction strategy implemented

from earlier this year and the tax credit offered to Model 3 and Y by the US government

as part of the US Inflation Reduction Act (IRA). As it is reported that Tesla planned

to make its Model 3 facelift, internally known as Project Highland, from the Gigafactory

in Shanghai from this September, it is expected that the facelift model would

be delivered to customers from October. The Volkswagen group, where Volkswagen,

Audi, and Skoda belong to, posted a 40.1% YoY growth, taking the 2nd

place on the list. The growth of VW Group was driven by steady sales of Audi

E-Tron line-up including ID.4, a first, non-American EV model qualified for the

EV tax credit offered by the US government. The 3rd place was occupied

by the Stellantis Group supported by solid sales of both BEV and PHEV such as

Fiat 500e and Jeep Wrangler 4xe.

(Source: Global EV & Battery Monthly Tracker – August 2023, SNE Research)

Hyundai-KIA

Motor Group posted an 8.0% YoY growth led by IONIQ 5 and EV 6 to which E-GMP platform

is installed. The Group, which broke the profit record in the 1st

half of this year, is expected to gradually expand its global market share as

the global sales of IONIQ 6, the All-new Kona Electric, and EV9 hit their

stride. The SAIC Group, a strong player in the Chinese domestic market, safely

entered the top 10 on the list with a triple-digit growth, based on favorable

sales of MG-4, MG-5, ZS, and HS models in Europe and Asia (excl. China).

(Source: Global EV & Battery Monthly Tracker – August 2023, SNE Research)

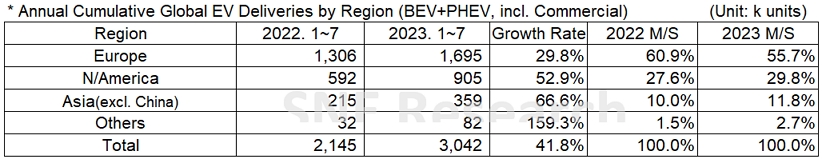

Chinese

EV makers such as BYD and MG, who have already secured their shares in the

Chinese domestic market, started trying in earnest to enter the global market

based on their vehicle safety and quality that were proved in China as well as

their price competitiveness since the growth in the Chinese domestic market gradually

slowed down. However, with the French government regulations added to the US

IRA and EU’s CRMA, a red light has turned on for the Chinese companies’ attempt

to expand their shares in the North American and European regions. In this

regard, there seems to be a sign for more intensified competitions between the

Korean companies and the Chinese companies in order to take a bigger pie on the

global stage.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period.